What is the difference between a regular auto loan and a military auto loan? The choices facing auto buyers are myriad and when you are sitting in front of a car salesman with the car of your choosing on the line, you want to know the ins and outs of what kinds of loans are available to you. The time to research is before you go car shopping.

If you have served in any branch of the military or your spouse has served in the military you likely qualify for loans specifically created for military personnel. But what are they exactly and how do they benefit you?

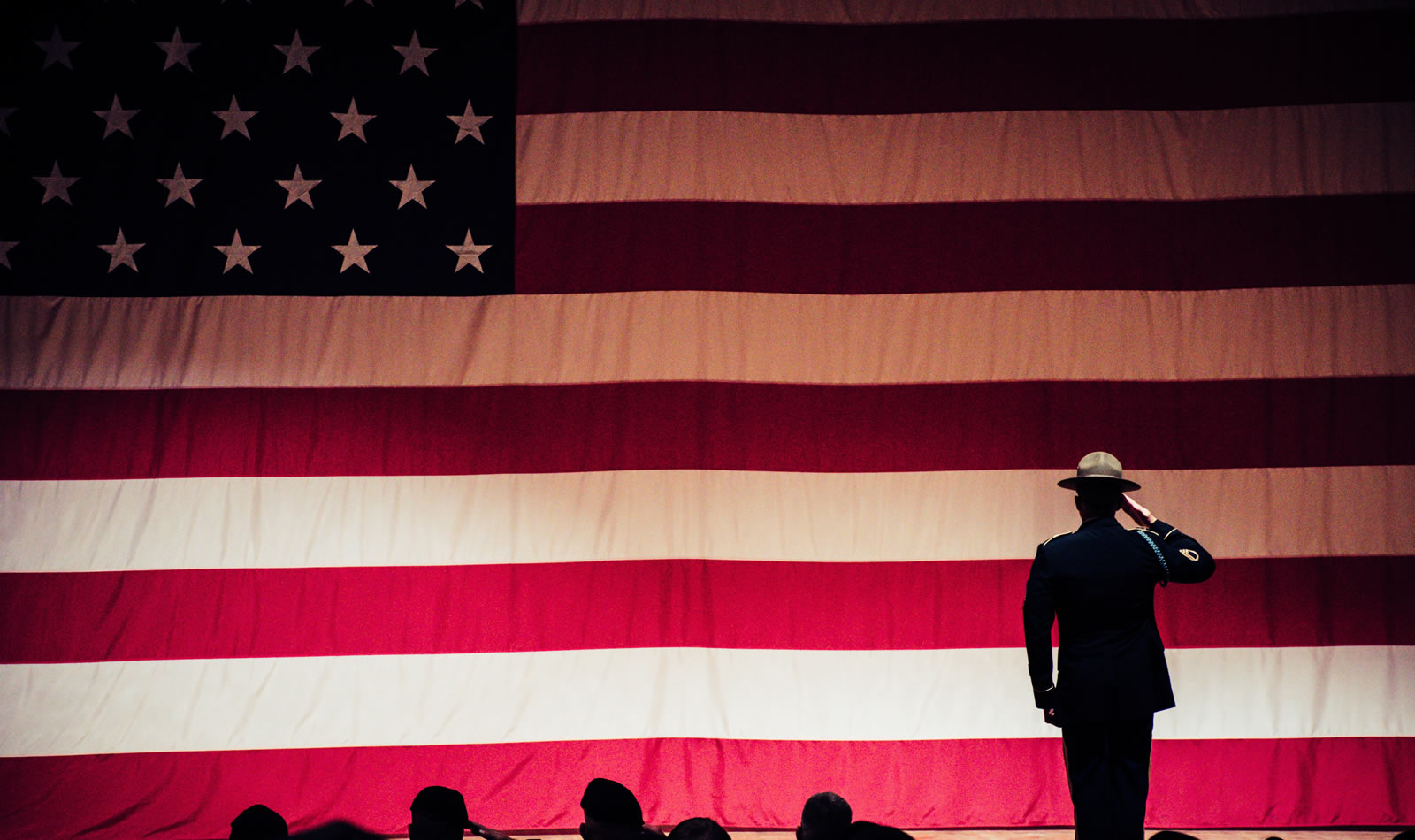

What is different about these loans is they are only available to military personnel or those retired from the military who served for twenty years or more. They are designed to benefit those who set aside time and put their lives on the line to serve their country. They are one of the benefits offered to those who put themselves in the path of service and whose families also sacrificed for the benefit of the United States government and citizens.

Military Personnel loans generally have lower interest rates. This benefits the buyer in that over the course of the auto loan you end up paying less for your vehicle. It also lowers your monthly payment as interest rates are included in the overall payment depending on the time it takes you to pay the loan. For example: say you buy a vehicle at the sticker price of $15,000, with a loan that has a 10% interest rate over four years; your monthly payment amount will be around $380.00 a month. (Depending on your state sales taxes, etc.) By the time you pay off the loan you will have actually paid around $18,300.00 for your vehicle.

Change that interest rate to 7% and your monthly payments will be around $350.00 a month with the end total being around $17,200. You will have saved over $1000.00.

Military Personnel also have available to them the option of a lower or no down payment on a vehicular loan. This can make a big difference as most auto dealerships require at least a 10% down payment. A family trying to begin a civilian life or just needing a new car while a spouse is serving in the military can greatly benefit from not needing to come up with a down payment. How many of us really are able to plan for when a vehicle needs replacing. Particularly when families are involved, the benefit of having a lower to no down payment makes a difference.

In addition if you are a first time buyer or have problems with your credit a military personnel loan is more forgiving. Most often, your credit plays a big role in whether or not you qualify for a loan as a civilian. It also dictates what sort of interest rates you qualify for. With auto loan interest rates being as high as 30% for truly bad credit, the benefit of having a military personnel loan with the forgiveness of credit issues is huge. The credit holders understand that running a family with one or more parents away a good part of the year is more than difficult, it is a sacrifice and that sacrifice is acknowledged a little bit with loans like these.

In addition some car companies and dealers offer additional discounts to military personnel and veterans particularly at certain times of the year. Do your research and make sure you are getting the best deal.

Situations where you may want to pass on military loans do exist. For example if you have enough money saved to buy a car outright, you should do it. Not having a monthly payment pulling from your budget is always a good thing.

You should also be aware that while they are called military loans, they are not loans offered by the military or the government. These loans are held by private companies and the same laws governing other loans apply to them. There is no forgiveness if you fall behind or default on them and you will be subject to collection just like with any other loan if you default.

However, they are better rates generally speaking than offered to the general public. They are a good way to build your credit rating which is important for your financial profile. It will help with securing loans for a home and for other ventures you may enter into in the future.